If you’ve ever felt frustrated by what your insurance won’t cover, how long it takes to get answers, or how limited your options feel—this article is for you.

There’s a shift happening in healthcare.

It’s subtle, but powerful.

And it’s being driven by patients, not insurance companies.

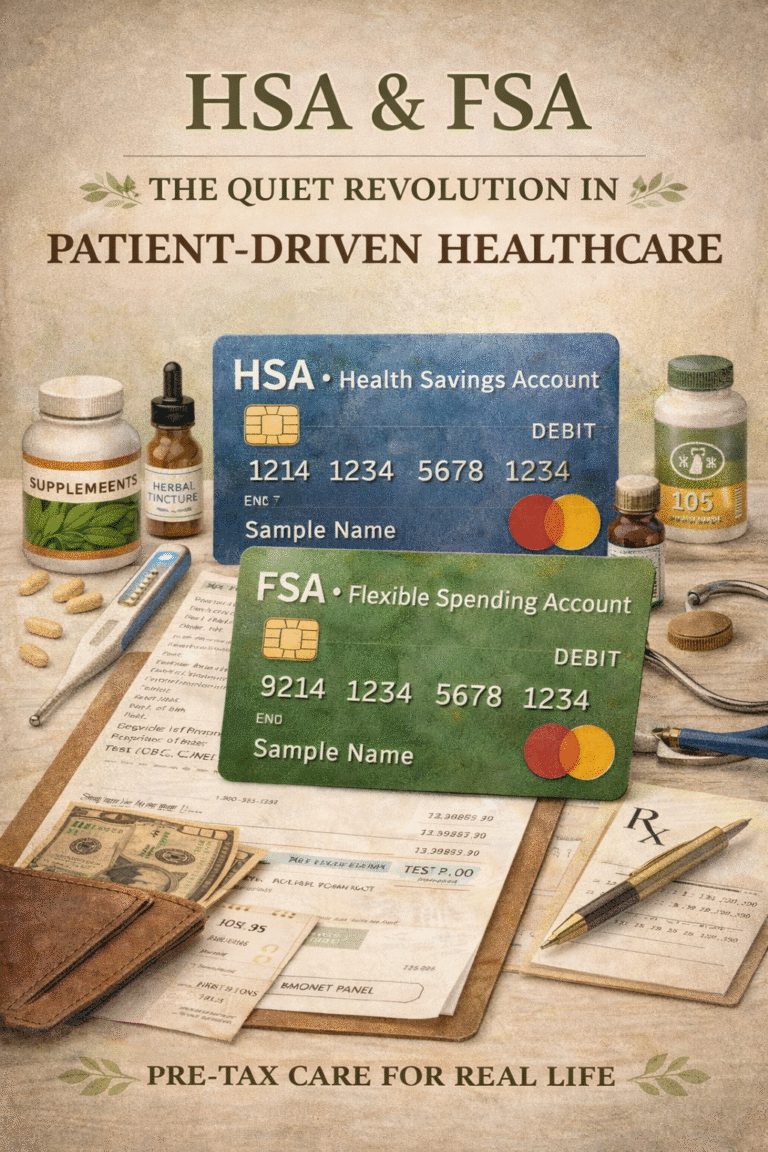

Two tools are at the center of this shift: HSA and FSA accounts.

At Antigravity Wellness, we proudly accept HSA and FSA funds because they align perfectly with how we believe healthcare should work: personalized, proactive, and patient-driven.

__________________________________________________________________________

What are HSA and FSA accounts?

Health Savings Account (HSA)

An HSA is a tax-advantaged savings account used to pay for qualified medical expenses.

Key features:

Available with qualifying high-deductible health plans

Funds roll over year to year

Money belongs to you

Can be used now or saved for future care

Triple tax advantage (pre-tax contributions, tax-free growth, tax-free medical spending)

__________________________________________________________________________

Flexible Spending Account (FSA)

An FSA is an employer-sponsored account that also uses pre-tax dollars for medical expenses.

Key features:

Funds are typically “use it or lose it” within the plan year

Some plans allow a grace period or small rollover

Great for planned or ongoing healthcare expenses

__________________________________________________________________________

Why this matters more than ever

Traditional insurance-based healthcare is built around:

Short visits

Symptom suppression

Limited prevention

Rigid rules around what’s “covered”

HSA and FSA accounts flip the script.

They allow you to decide:

Who you work with

How much time you get

What type of care aligns with your goals

Whether you want reactive care or proactive optimization

This is one reason we believe HSA/FSA use is the next revolution in patient-driven healthcare access.

__________________________________________________________________________

Why HSA/FSA works so well with functional & integrative care

At Antigravity Wellness, we don’t just chase symptoms.

We look at:

Hormone physiology

Nutrition and metabolic health

Exercise and recovery

Stress and nervous system regulation

Sleep, lifestyle, and long-term vitality

This kind of care:

Takes time

Requires education and partnership

Focuses on root causes

Prioritizes prevention and quality of life

HSA and FSA funds allow women to invest in care that actually moves the needle, instead of waiting for problems to escalate.

__________________________________________________________________________

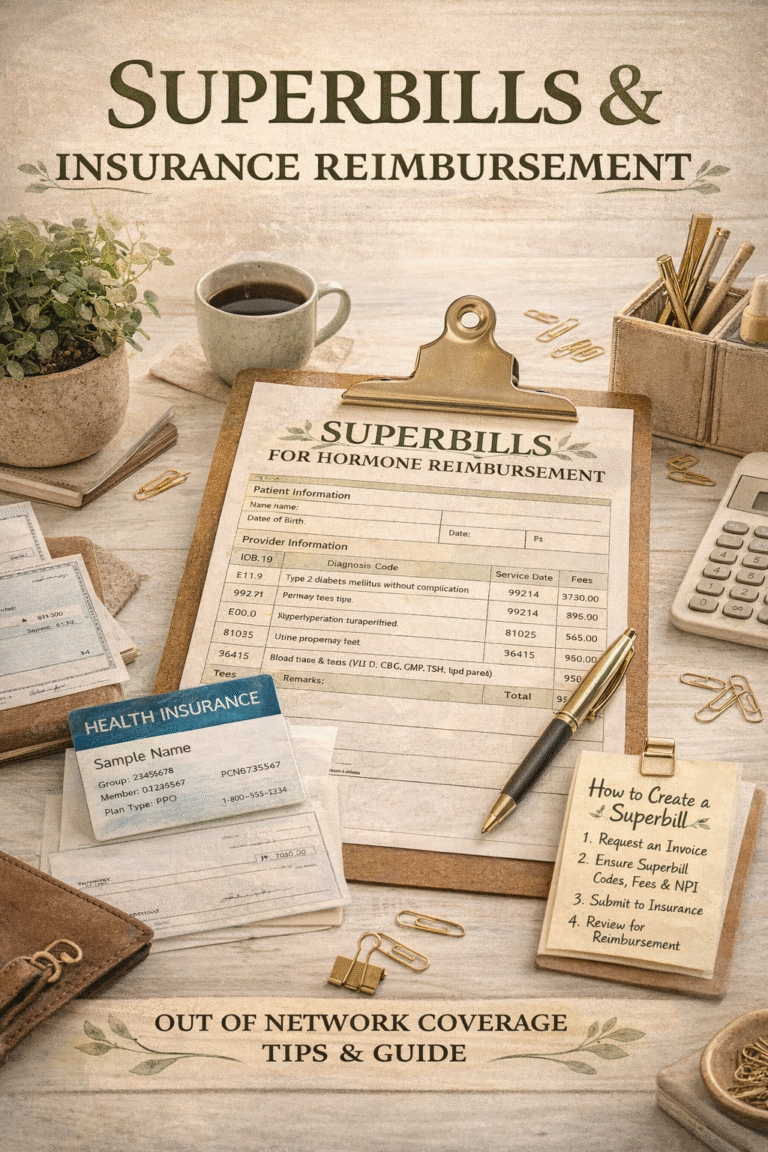

What services can HSA/FSA typically be used for?

While individual plans vary, HSA and FSA funds are commonly used for:

Medical consultations

Functional lab testing

Hormone evaluations and management

Preventive care and diagnostics

Chronic condition support

Certain supplements (when medically indicated)

At Antigravity Wellness, many of our services qualify because they are medically grounded, provider-led, and focused on health outcomes, not trends.

We always recommend checking with your plan administrator if you have specific questions—but most patients are pleasantly surprised by how flexible these accounts are.

__________________________________________________________________________

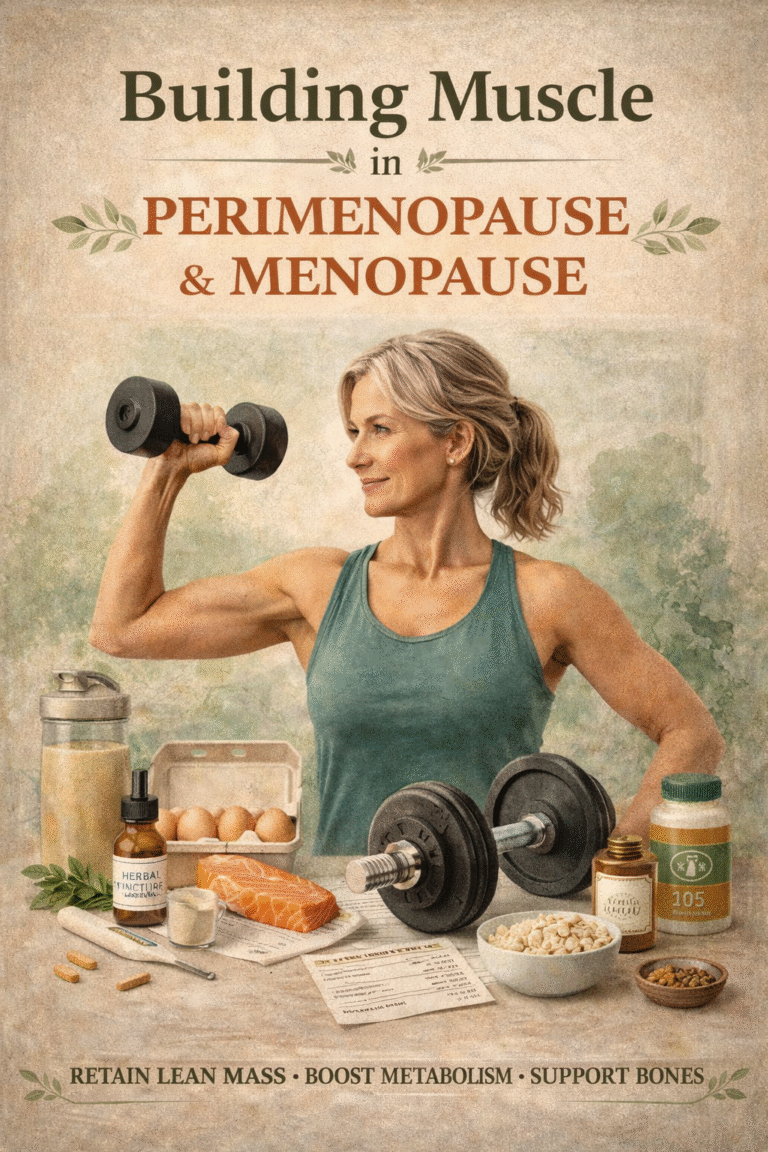

Why this empowers women in midlife especially

Perimenopause and menopause are often when women:

Use healthcare the most

Feel heard the least

Spend the most out-of-pocket trying to feel better

HSA/FSA accounts give women:

Choice

Autonomy

Financial clarity

Permission to invest in themselves

Instead of waiting for insurance approval, women can access the care they need when they need it.

That’s not indulgent. That’s smart healthcare.

__________________________________________________________________________

How this fits into care at Antigravity Wellness

At Antigravity Wellness, we believe:

Women deserve time, education, and partnership

Hormones are one piece of a much bigger picture

True healing requires addressing lifestyle, stress physiology, nutrition, movement, and mindset

Patients should be empowered—not rushed or dismissed

Accepting HSA and FSA funds is one way we support this philosophy.

It allows women to:

Use money they already set aside for healthcare

Access care aligned with their values

Invest in long-term vitality, not short-term fixes

__________________________________________________________________________

Is this the future of healthcare?

We believe so.

As more patients:

Demand personalized care

Seek prevention instead of crisis management

Want transparency and control

HSA and FSA accounts will continue to play a major role in reshaping how healthcare is delivered.

This isn’t concierge medicine.

It’s conscious, patient-driven care.

__________________________________________________________________________

Are We a Good Fit?

If you’re exploring care at Antigravity Wellness and wondering whether your HSA or FSA can be used, the best next step is clarity.

We invite you to complete our Readiness Questionnaire, which helps determine:

Whether our model of care aligns with your goals

What level of support is appropriate

Whether now is the right time to begin

Our goal is alignment—not pressure.

👉 Take the Readiness Questionnaire to explore next steps.

__________________________________________________________________________

Medical Disclaimer

This article is for educational purposes only and is not intended to provide tax, legal, or medical advice. HSA and FSA eligibility and qualified expenses may vary by plan. Always consult your plan administrator, tax professional, or healthcare provider for guidance specific to your situation. Medical services should be discussed with a qualified healthcare professional before initiating care.

__________________________________________________________________________

References

1. Internal Revenue Service (IRS).

Publication 969: Health Savings Accounts and Other Tax-Favored Health Plans.

U.S. Department of the Treasury.

— Official IRS guidance defining HSAs, FSAs, eligibility, rollover rules, and qualified medical expenses. https://www.irs.gov/publications/p969

2. Internal Revenue Service (IRS).

Publication 502: Medical and Dental Expenses.

U.S. Department of the Treasury.

— Authoritative list of what qualifies as a medical expense for HSA/FSA use, including provider services, diagnostics, and certain supplements when medically indicated. https://www.irs.gov/publications/p502

3. Consumer Directed Healthcare: Except for the Healthy and Wealthy It’s Unwise. https://pmc.ncbi.nlm.nih.gov/articles/PMC2071952/

4. Tax Credits for Health Insurance and Medical Savings Accounts. https://tinyurl.com/y3ursxz3

5. Buntin, M. B., et al. (2011).

Consumer-directed health care: Early evidence about effects on cost and quality.

Health Affairs, 30(6), 1039–1047.

— Reviews outcomes related to patient-controlled healthcare spending and engagement. https://pubmed.ncbi.nlm.nih.gov/17062591/

6. Making Sense of “Consumer Engagement” Initiatives to Improve Health and Health Care: A Conceptual Framework to Guide Policy and Practice. https://tinyurl.com/yk55u6as

7. Centers for Medicare & Medicaid Services (CMS).

National Health Expenditure Data: Out-of-Pocket Spending Trends.

— Demonstrates the growing role of out-of-pocket and patient-directed healthcare spending in the U.S. https://tinyurl.com/yc5nw2ay

8. Rosenbaum, S. (2011).

The patient protection and affordable care act: Implications for public health policy and practice.

Public Health Reports, 126(1), 130–135.

— Contextualizes how gaps in coverage increase reliance on patient-directed spending tools like HSAs and FSAs. https://pmc.ncbi.nlm.nih.gov/articles/PMC3001814/